See Disclaimer below

Applus+ Technologies, Inc. is founded in 1996 in Spain, provided vehicle emissions inspection services necessary for state compliance with the clean air mandates enforced by the U.S. Environmental Protection Agency. In 2000, it enters the US Market through the acquisition of Keating, the market leader in vehicle emissions control.

In 2002, company sets out its strategic vision and the Applus+ brand is launched worldwide. By 2002, the firm has become America’s most experienced program management contractor in the field of vehicle safety inspection and emissions testing.

In 2007, Applus+ group of companies is acquired by the Carlyle Group, a global investment firm with more than $97 billion under management.

Applus+ belongs to the testing, inspection and certification sector. It has a workforce of over 25,000 employees across multiple sectors in more than 70 countries. They offer portfolio of solutions that address a range of needs, from asset integrity management to statutory compliance-based inspections. Let's go through the valuation journey (see post at https://www.ecointelfinance.org/post/the-valuation-journey)

Market Side

Step 1: Characterize the company into an industry to which valuing company belongs

The inspection, testing, and certification (ITC) industry provides third-party services to assess and verify the quality, safety, and compliance of products, processes, and systems. This industry includes companies that specialize in testing and analyzing products for compliance with national and international standards, certifying products and services, and inspecting and auditing facilities and processes to ensure safety and regulatory compliance.

The ITC industry serves a wide range of industries, including automotive, construction, electronics, energy, food, healthcare, and manufacturing. Some of the key services provided by the industry include product testing, quality control, certification, and inspection of production processes and facilities. Companies in the ITC industry work with manufacturers, suppliers, retailers, and governments to ensure that products and services meet the required quality and safety standards.

The ITC industry is highly regulated and subject to various industry-specific standards and regulations. Companies in the industry must comply with national and international standards, such as ISO 9001, ISO 14001, and OHSAS 18001, and adhere to industry-specific regulations, such as those set by the U.S. Food and Drug Administration (FDA), the European Union's Restriction of Hazardous Substances (RoHS) directive, and the International Electrotechnical Commission (IEC).

Applus belongs to the Testing, Inspection and Certification industry related subdivision of energy sector providing Oilfield Equipment and Services.

According to TIC council the industry provides independent third-party conformity assessment services in a variety of contexts – e.g., to support regulatory frameworks or industry oversight programs – using technical experts to carry out impartial testing and evaluation, audits, inspections, and other services on products, systems, or personnel against various private, national and international standards and regulations.

TIC companies can also certify for consumers, patients, workers, regulatory authorities, governments, and firms up- and down-stream in chain of production, that a product meets a set of specified requirements – whether to address a specific hazard or risk, ensure quality, or meet some other objective – and that it will consistently do so for as long as it holds the relevant certification. TIC firms can also support enhanced market access by providing related services such as measurement of volumes and weights, sampling of commodities, and laboratory analysis of cargo.

1. Testing: determination of one or more characteristics of an object of conformity assessment, according to a procedure.

2. Inspection: examination of a product design, product, process or installation and determination of its conformity with specific requirements or, based on professional judgement, with general requirements.

3. Certification: third-party attestation related to products, processes, systems, or persons.

According to a TIC council report, current estimates of the size of the conformity assessment sector globally, including first, second- and third-party activities with all their constituent applications, are in the order of $200bn, and it is expected to surpass $260bn by 2025.

The independent TIC sector is currently estimated to account for 40 per cent of this. A trend of increased outsourcing of TIC services to cost-effective third parties, coupled with a diversified range of products and standard requirements, has contributed to the growth of the independent share from approximately 36 per cent in 2017

TIC companies cater to a diverse range of industry sectors across the world with differing standards and legislation, servicing virtually all economic operations and ranging from automotive, commodities, consumer, environmental, food, life sciences, industrial, maritime, medical, oil & gas, petrochemical, leisure, education, systems, compliance, trade assurance and many more.

The industry is divided into three segments, viz. Testing, Inspection, and Certification. Buyers demand for inspection depends on regulatory compliance for maintenance of critical infrastructure in energy, health, pharmaceuticals, and food industry apart from others.

Non-destructive Testing or Inspection (NDT) consists of non-invasive inspection techniques used commonly for mechanical equipment, structures, and piping systems to locate and determine the defect features such as size, shape, and orientation. It ensures cost efficiency, safety, and quality assurance while preventing any failure to be caused. Various techniques are used in the inspection industry and include conventional as well as advanced methods.

Conventional NDT techniques: Visual Inspection (VT), Ultrasonic Flaw Detection Testing (UT), Magnetic Particle Testing (MPI), Liquid Penetrant Testing (LPT), Positive Alloy Material Identification (PAMI) and Painting & Coating inspection

Advanced NDT Techniques: Phased Array Ultrasonic Testing (PAUT), Time of Flight Diffraction Testing (ToFD), Corrosion mapping using Phased Array UT (C Scan, B Scan), Eddy Current Testing (ECT), Remote Field Electromagnetic Testing (RFET), Internal Rotating Inspection System (IRIS), Near Filed Testing (NFT), Tank floor bottom plate scanning by using Magnetic Flux Leakage technique (MFL), Long Range Ultrasonic Testing (LRUT), Wire Rope testing, Remote Visual Inspection (RVI), Low Frequency Eddy Current Testing (LFET), Alternating Current Field Measurement (ACFM), Infrared Thermography, Pulsed Eddy Current (PEC), Corrosion Under Insulation (CUI), ECT weld surface inspection

Testing Services: This includes among other things, Structural Testing, Materials Testing, Building Product Testing, Fire Testing, EMC, Wireless and Electrical Safety Testing, Environmental Testing, Cybersecurity Evaluations, and Materials Testing for CAE Simulation

Certification Services: This includes certification for Products, Management systems, Personnel certification, Welding Certification and Material Services, CE Marking and Management-system certification etc.

Step 2: Understanding the industry characteristics - Porter Five forces

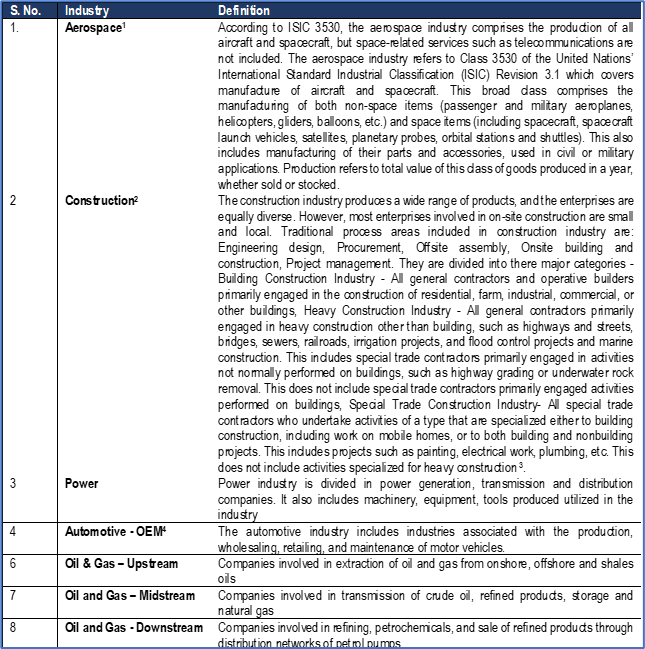

A. Bargaining power of Buyers : According to Porter’s industry, buyer power can be broken down into two primary segments: bargaining leverage which measure of leverage buyers have relative to target industry customers, and price sensitivity, which measure buyer sensitivity to changes in price. Higher bargaining power and more sensitive a buyer is towards price, the more power that buyer has, resulting in lower prices.

I. Bargaining Leverage

1. Buyer volume and purchase frequency: Most buyers in the TIC industry are driven by either regulatory compliance or are driven by reduction in production stoppages. The purchase frequency depends on the regulatory compliance schedule, which can be once or twice a year depending on the equipment for which services have to be provided. In terms of volume, it depends on infrastructure that the client has in a particular region for Opex related services and new builds or greenfield capex services.

2. Switching costs: The switching costs are low in the industry as customers can easily switch between competitors as services provided by the industry are very standardized.

3. Buyer information (with respect to competitive pricing, product specifications, sales process, etc.)

In mature and developed economies buyer has full information about the costs and processes followed to deliver the services. In developing economies, the information asymmetry persists.

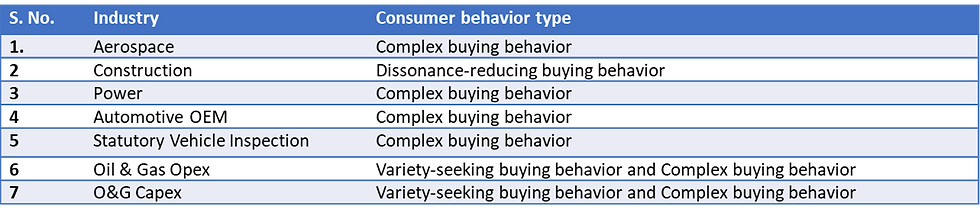

4. Buyer concentration: Buyer concentration depend on the industry served and countries served by the TIC companies. Before we provide numbers of companies within each industry, we need to define the industry:

In terms of number of buyers new companies are not getting added in the Aerospace, Construction, Energy or Automotive industries so only way to expand it to add clients in the existing portfolio.

II. Price sensitivity of consumers in Testing, certification and inspection industry: The price sensitivity of consumers in the Testing, Certification, and Inspection industry can vary depending on a number of factors such as the type of service, the industry sector, the level of competition, and the perceived value of the service.

In general, consumers in this industry tend to be quite price-sensitive, particularly in highly competitive markets where there are many service providers offering similar services.

However, for services that are considered critical to compliance or safety, consumers may be less price-sensitive and more willing to pay a premium for quality and reliability. Additionally, customers in some sectors such as healthcare or aerospace may be more willing to pay higher prices for testing, certification, and inspection services due to the high stakes involved in those industries. Overall, it is important for companies in this industry to find the right balance between price and quality, and to communicate the value of their services effectively to potential customers.

5. Threat of Backward integration

Threat of backward integration is a factor of capacity build-up in terms of personnel employment, process and equipment in the TIC industry. In some industries like oil and gas, the buyers have processes required to conduct inspection and testing services, but they will have to outsource the activity as it is not part of their core business portfolio. These services are in the nature of Maintenance, Repair and Overhaul category.

The threat of new entrants into the TIC industry is relatively low. This is because the industry requires substantial investments in technology, equipment, and personnel to operate efficiently. Moreover, established companies in the industry have built strong brand reputations, customer loyalty, and regulatory approvals, which make it difficult for new entrants to gain market share.

B. Bargaining power of Suppliers: The bargaining power of suppliers in the TIC industry is relatively low. This is because the industry requires a variety of equipment and supplies, which are readily available from multiple suppliers. Additionally, many suppliers depend on TIC companies for their business, which reduces their bargaining power.

C. Threat of Entry: The threat of new entrants into the TIC industry is relatively low. This is because the industry requires substantial investments in technology, equipment, and personnel to operate efficiently. Moreover, established companies in the industry have built strong brand reputations, customer loyalty, and regulatory approvals, which make it difficult for new entrants to gain market share.

D. Industry Rivalry: The competitive rivalry in the TIC industry is high. This is because the industry has many players, including large multinational companies and smaller regional firms. Additionally, the industry is highly fragmented, with companies competing on price, quality, and service. Moreover, many TIC companies have expanded their services to cover multiple industries and geographies, intensifying competition further.

E. Threat of Substitutes: The threat of substitutes in the TIC industry is relatively low. This is because the industry provides essential services, which are typically required by regulations and standards, and cannot be substituted easily.

In conclusion overall, the TIC industry is a highly competitive industry with high bargaining power of buyers and intense rivalry among existing players. However, the industry's significant entry barriers, low bargaining power of suppliers, and low threat of substitutes mitigate some of the competitive pressures.

Step 3: List and understand the business units into which the company that we value is divided

Applus+ is divided into:

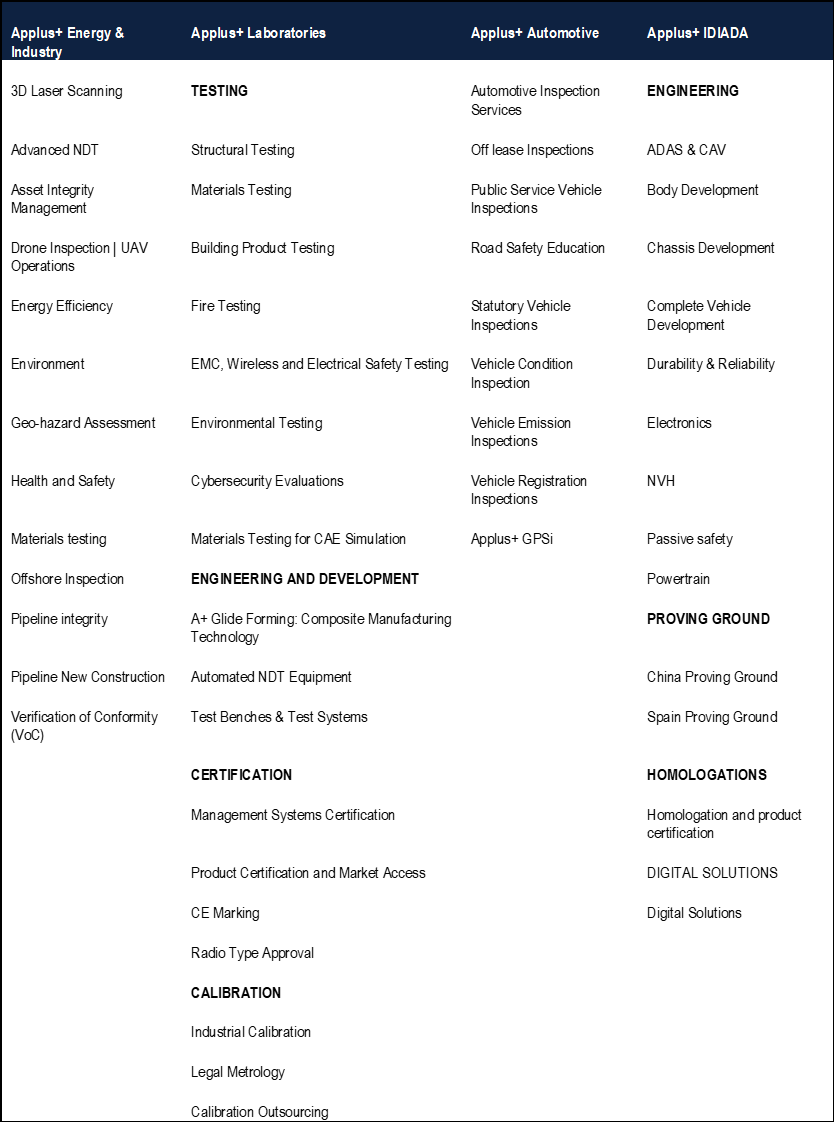

1. Applus+ Energy & Industry: Under this division it provides Engineering & Consulting Services, Inspection, certification services, Supervision and QA/QC, and Testing and Analysis.

2. Applus+ Laboratories: Under this Applus provides testing services, engineering, calibration and certification services to industries like Aerospace, Automotive, Construction, Drones & UAM, Electrical & Electronics, Industry & Transport, Information & Communications Technologies, Medical Devices, Pharma & Fine Chemicals, Pipes & Pipe Systems, Railway and Wind Power

3. Applus+ Automotive: It provides Inspection, certification services, Supervision and QA/QC, and Testing and Analysis for the automotive industry providing governments, manufactures and traders with the best solutions in improving vehicle safety and reducing harmful vehicle emissions services.

Key solutions

a. Roadside Inspections to support local authority enforcement of passenger and commercial vehicles.

b. Periodic and Non-Periodic Inspections that are mandatory for specific proactive or reactive reasons such as safety, voluntary, accident and quality.

c. Custom Inspections to ensure the conformance of new or used vehicles entering a country. Registration Inspections to ensure that vehicles meet legislative standards prior to registration.

d. Alteration/Modification Inspections that are mandatory after modifications are made to vehicle.

e. Special Inspections that complement periodic vehicle inspections (ADR, ATP, taximeters and others).

f. On Board Diagnosis (OBD) for gas emissions and electronic vehicle inspections.

g. Biometric fingerprint scanning for access authentication

h. Electronic iris scanning for access authentication Remote video monitoring Kiosk-based self-service testing.

4. Applus+ IDIADA: It serves clients in product development activities by providing design, engineering, testing and homologation services. Homologation is the process of certifying that a particular vehicle is roadworthy and matches certain specified criteria laid out by the government for all vehicles made or imported into that country.

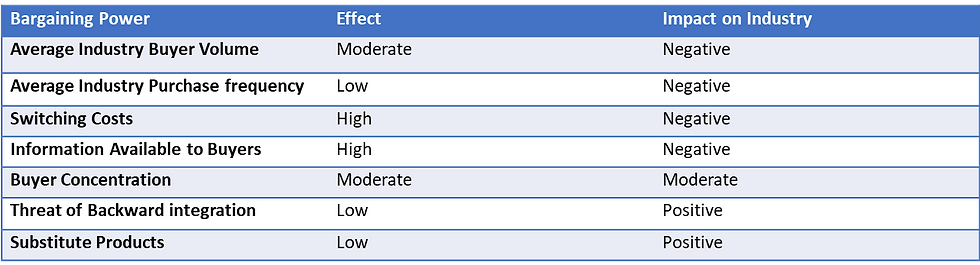

Steps 4: Understand the consumer behavior from the market demand side for each business unit

The field of consumer behavior is the study of individuals, groups, or organizations and the processes they use to select, secure, use, and dispose of products, services, experiences, or ideas to satisfy needs and the impacts that these processes have on the consumer.

According to QuestionPro[1] website, it is a multi-stage process that involves identifying problems, collecting data, exploring options, making a decision to buy, and evaluating the experience afterward. Consumers may be impacted during these stages by things including personal views and values, social conventions, marketing campaigns, product features, and environmental conditions.

Understanding consumer behavior is essential for businesses to create marketing plans that work and to supply goods and services that satisfy customers’ wants and needs. To see trends and patterns, forecast demand, and make wise choices regarding product design, price, promotion, and distribution, marketers must analyze and understand data on customer behavior. The website further types of consumer behaviors. [1] https://www.questionpro.com/blog/consumer-behavior-definition/

4 Types of Consumer Behavior

1. Complex buying behavior

When customers are actively involved in the purchasing decision process and are aware of the significant differences between the various brands, this happens. Before making purchasing decisions, consumers conduct extensive research, gather information, and evaluate alternatives.

2. Dissonance-reducing buying behavior

This type of behavior happens when people make expensive or risky purchases and then feel uncomfortable or confused about their decision. Consumers may seek reassurance, information, or feedback from others to reduce confusion.

3. Habitual buying behavior

This happens when customers make purchases with minimal decision-making and marketing efforts or information search. Based on prior experiences, they have developed brand and customer loyalty also buying habits, and they may buy things out of habit, convenience, or familiarity.

4. Variety-seeking buying behavior

This type of behavior happens when customers are not deeply involved in the purchase decisions but seek variety or uniqueness in their purchases. They may most often change brands or products to satisfy their curiosity or need for variety.

For Applus key industries served and consumer behavior are presented below:

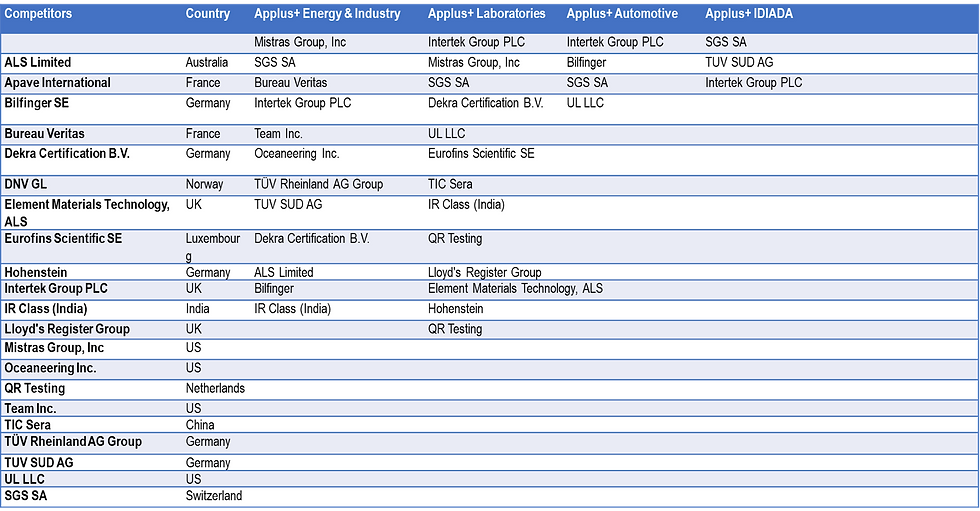

Step 5: List and analyze competitors in each business unit from the perspective of product and services, pricing, supply channels, promotion activities - The Marketing Mix

Services

Applus provides following services in 70 countries in various regions around the world to various industries which include mainly Energy, Automotive, Pharmaceuticals, Electricity & Electronics and Renewables.

Table: Services and industries served

Table: Business-wise Competitors and services under each business unit

Contracting in TIC Industry

Contracting is a common practice in the Testing, Certification, and Inspection industry, particularly for larger projects or ongoing services. Contracting allows both the service provider and the customer to establish clear expectations, deliverables, and timelines for the work to be performed.

Contracting in this industry can take many forms, depending on the nature of the services being provided and the specific needs of the customer. For example, a contract might be structured as a fixed-price agreement, where the service provider agrees to deliver a specific set of services for a set fee. Alternatively, a contract might be structured as a time-and-materials agreement, where the customer pays for the actual time and materials used by the service provider to perform the work.

In addition to outlining the scope of work and payment terms, contracts in this industry often include provisions for quality control, confidentiality, and liability. For example, a contract might require the service provider to adhere to specific testing standards or procedures, or to maintain confidentiality with respect to the results of the testing or inspection.

Overall, contracting is an important tool for managing risk and ensuring that both the service provider and the customer are on the same page with respect to expectations and outcomes.

Pricing

To understand pricing of the services provided by Applus we need to understand the contracts that are prevalent in the industry.

1. Master Sales Agreement: It is contract is an agreement between a buyer and seller that establishes the framework for future purchases of goods or services. The key element of contract is that it allows the buyer to place orders for goods or services as needed, without having to go through a formal bidding process each time

2. Call off contract means this is a contract between the Customer or contracting body and the Supplier (entered into pursuant to the provisions of the Framework Agreement), which consists of the terms set out in the Call Off Order Form and the Call Off Terms.

3. One-off contract: This is a contract in which there is only one time opportunity related to inspection, testing and certification. The contract can be in form of tender or unsolicited proposals.

The Master Sales agreement does not specify and pricing schedule but includes pricing terms and what it should include and exclude. The call off contract and one-off contract mentions the clear pricing schedule and terms and conditions for delivery obligations. Price is determined based on technical personnel and equipment rentals mentioned in the contract. Price of personnel depends on the level of certification, experience, and type of service to be supplied.

There are two pricing models used in the industry:

1. Cost plus margin: This is a simple model in which certain percentage is added to the cost of employee and equipment rentals costs. Cost-plus pricing is a pricing strategy in which a company sets the price of a product or service by adding a markup to the cost of producing or delivering it. The markup is typically a percentage of the cost, and it represents the profit margin that the company expects to make on the sale.

The cost component of cost-plus pricing includes all the direct and indirect costs associated with producing or delivering the product or service. Direct costs are those that can be directly attributed to the product or service, such as raw materials, labor, and production overheads. Indirect costs are those that cannot be directly attributed to the product or service, such as rent, utilities, and administrative expenses.

2. Value based on differentiation strategy

Most of the competitors are follow cost plus margin pricing but there are firms in the industry that have started using value-based pricing based on technology development in inspection techniques with use of drones, robots and crawlers, Unmanned Aerial Vehicles and remote visual inspections.

Key players in inspection robots – a disruptive innovation in the oil & gas industry

Source: GlobalData Analytics

The problem with the cost plus margin based pricing is there is low scope for increasing the prices as the customers have information about competitors costs as there is no information asymmetry that can be exploited by firms in the industry as the only value proposition is price – lower the better. Only in few regions were the industry is not well developed in terms of number of competitors and information availability higher prices can be charged.

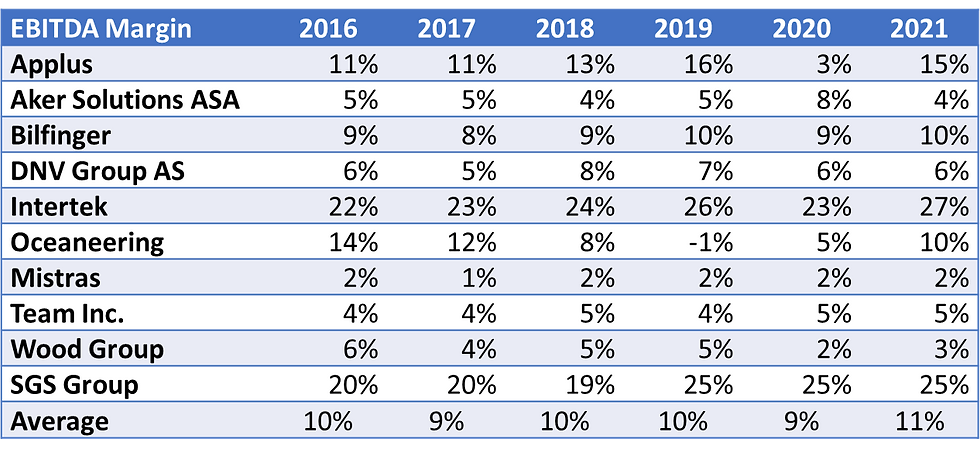

This can be seen from the EBITDA margins that competitors in the industry have achived in last 5 years. The Table below points to this fact.

Place / Distribution Channels

The industry does not follow any specific distribution channels to supply these services. These companies serve the customers from the offices in the specific client country or through mobilization of equipment and technical personnel’s from nearby countries of presence.

Promotion and Branding

Branding and promotion activities followed by companies in the TIC industry are different from traditional B2B companies that are into products. The key promotion activities involved here are through presentations in conferences, discussion papers published in B2B journals and magazine within the industry served and participation in trade fairs.

Competitors of Applus+ have adapted branding approach for certain in there portfolio like Mistras with its Bridge Monitoring and Inspection Solution Into New StructurAlert(TM)[1] Name in 2015 but they are few and far in between.

[1] https://www.globenewswire.com/en/news-release/2015/11/06/784815/12235/en/MISTRAS-Brands-Its-Latest-Bridge-Monitoring-and-Inspection-Solution-Into-New-StructurAlert-TM-Name.html

Disclaimer

"This valuation report has been prepared solely for education purposes of determining the estimated fair market value of the subject business. The valuation is based on the publically available information and is subject to assumptions and limiting conditions set forth in this report. The valuator has not independently verified any of the information provided and assumes no responsibility for its accuracy or completeness.

This report is not intended for use in any legal proceeding or for any other purpose without the prior written consent of the valuator. The valuator does not provide any opinion or assurance as to the future financial performance of the subject business, nor does this report consider any potential changes in economic, legal, or regulatory factors that could impact the valuation.

The valuator accepts no responsibility or liability for any damages arising out of or in connection with the use of this report or the conclusions drawn from it. This report is not a recommendation to buy, sell, or hold any securities, nor does it constitute an offer or solicitation of an offer to buy or sell any securities. The valuator disclaims any and all express or implied warranties, including warranties of fitness for a particular purpose, merchantability, or non-infringement of intellectual property rights."

Commenti