To understand the impact of new pricing guidelines on Oil and Gas producers, City Gas Distribution companies and customers of CNG and PNG (Domestic) we need to understand production, consumption scenarios, pipline infrastrcture, pricing regime followed in India before the announcement of new pricing guidelines and future price scenarios.

India natural gas production and consumption scenario

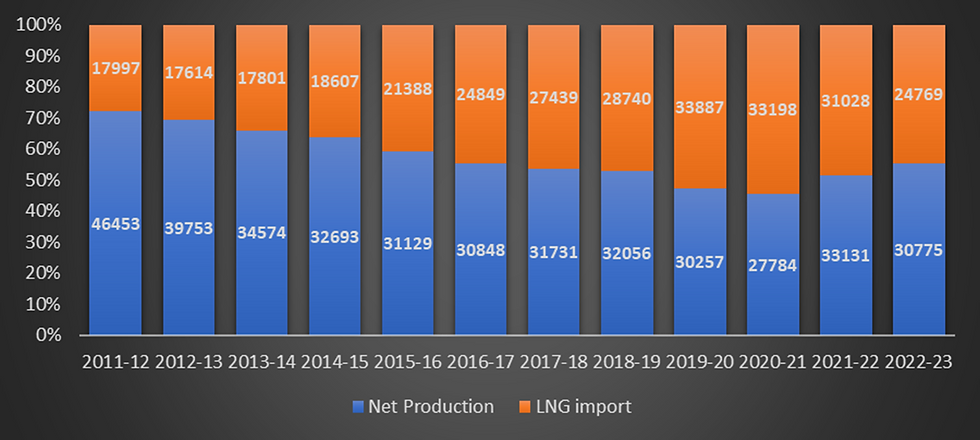

As per Petroleum Planning and Analysis Cell (PPAC) data, LNG consumption as a percentage of Total Consumption (Net Production + LNG imports) was 72% in 2011-12 and fell to 47% in 2019-2020 but has started to rise again as Net domestic production (Gross Production - Flaring) has started to fall.

Trend of Natural Gas Consumption in India (including internal consumption) (MMSCM)

*For 2022-23, data is available till February 2023 only

Source: PPAC

Trend of LNG share as percentage of Net Production and LNG Imports

Source: PPAC

In case of domestic production India gets its gas from nomination fields, Pre-NELP fields (Discovered and Exploration fields), NELP fields, Coal Bed Methane fields and discovered small fields. We produce natural gas from both onshore and offshore fields - Shallow water, Deepwater and Ultradeep water. To add to oil and gas reserves, India embarked on the Hydrocarbon Exploration and Licensing Policy (HELP) and Open Acreage Licensing Programme (OALP) Offshore Bid Round under it from July 1, 2017.

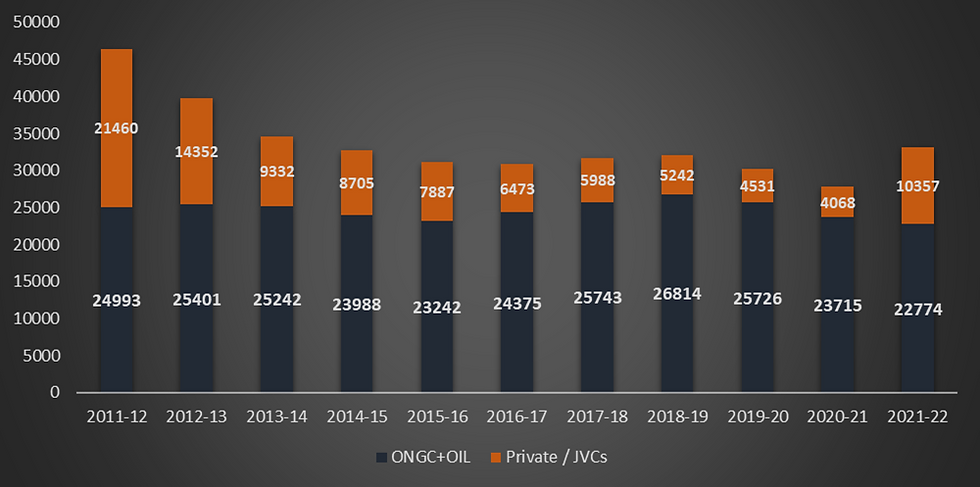

Production of Natural Gas in India is falling since 2011. Production from Private and JV companies have been consistently falling with net production almost getting halfed in 2021-22 from 2011 levels. In fact it has fallen to almost one-fifths in 2018-2019 and 2019-2020 fiscal years.

Trend of Natural Gas Production in India (MMSCM)

Source: PPAC

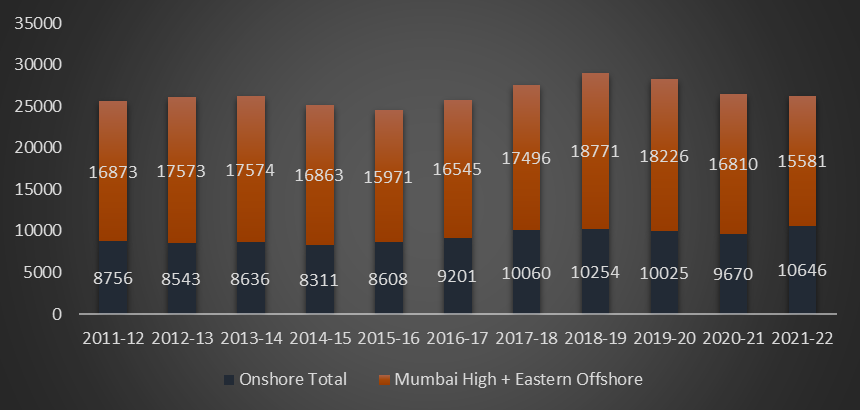

Trend of Natural Gas Production in India (MMSCM) - Onshore and Offshore

Source: PPAC

It can be observed net production from Mumbai High + Eastern Offshore has fallen continuously in last three year not only due to Covid-19 but also because of old and aging fields of ONGC which contributes 71% to India's production, and lack of investment by private players and gap in auctioning of oil and gas field between NELP and HELP policy.

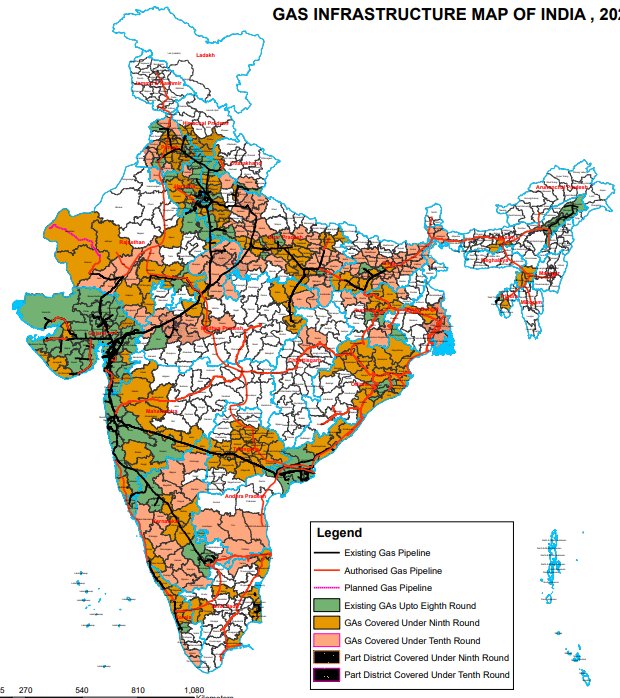

Gas infrastructure in India

Source: PNGRB

Pricing of Natural Gas in India

In 2012, Government of India constituted a Committee on Gas Pricing under Chairmanship of Dr. C Rangarajan, the then Chairman of the Economic Advisory Council to Prime Minister to investigate the Production Sharing Contract mechanism to determine basis of formula for gas pricing from domestically produced oil and gas fields. Thereafter, the Government notified the "Domestic Natural Gas Pricing Guidelines", 2014 on January 10, 2014, setting out the formula for the price of domestically produced natural gas, based on the recommendations of the Committee. The notification was to be implemented with effect from April 1, 2014, but Election Commission deferred the notification of Gas Price till completion of 2014 general elections.

On August 13, 2014, Ministry of Petroleum and Natural Gas constituted a committee to re-look into the pricing mechanism. As per the report of the committee, different pricing regimes were followed for natural gas produced in India which come from Nomination fields, Pre-NELP fields (Discovered and Exploration fields), NELP fields, Coal Bed Methane fields and discovered small fields. These price regimes followed in India were Administered Pricing Mechanism (APM) and Non-Administered Pricing Mechanism.

Administrated Pricing Mechanism (APM)

Gas produced from existing or nominated blocks of National Oil Companies (NOC) i.e. Oil and Natural Gas Corporation (ONGC) and Oil India Limited (OIL) were priced at APM rates. Government fixed the price at US$ 4.2 per mmbtu inclusive of royalty except the Northeast, where it was US$ 2.52 per mmbtu (60% of APM price elsewhere). The balance 40% was paid as subsidy to NOC's from government budget.

The Committee noted" Owing to existing supply linkages and operational requirements, it would happen that customers entitled for APM gas physically get market priced gas and vice versa. It was

decided to have a Gas Pool Account mechanism with inflows coming from sale of APM gas to consumers not entitled for APM gas at market price and outflow being for purchase of non-APM gas for supply to customers entitled for gas at APM price."

Non-APM Gas produced by NOCs from Nominated Fields

NGC and OIL were in principle free to charge a market-determined price for gas produced from new fields in their existing nominated blocks. Government issued guidelines for commercial utilization of non-APM gas produced by NOCs from such new fields in their nominated blocks in the four zones. These zones are:

Western & Northern Zones (covering Maharashtra, Gujarat and other States covered by HVJ/DVPL viz Rajasthan, Madhya Pradesh, Uttar Pradesh, Haryana and Delhi)

Southern Zone - KG Basin

Southern Zone - Cauvery Basin

North-East

Identified onshore fields in Gujarat and Rajasthan

Pre-NELP Gas

Some of the blocks discovered by NOCs were auctioned under Production Sharing Contract (PSC) to private sector. These PSC were Panna-Mukta, Tapti (PMT) and Ravva. The entire gas was sold to GAIL as per the pricing formula specified in PSC. The price for these PSCs were discovered through limited tender and GAIL matched the highest price.

In case of PMT gas fields, the price formula of gas was linked to international traded fuel oil basket with a floor and ceiling.

Pricing under Small-sized discovered fields & Pre-NELP Exploratory Blocks

Sale of gas from 24 small sized discovering fields and 28 pre-NELP blocks were based on market prices discovered through arm's length principle for private E&P companies in case if it is not sold to GAIL and for others pricing formula and prices did not need government's approval.

New Exploration and Licensing Policy (NELP)

Under the NELP Round I, gas pricing was based on arm's length prices through open bidding process but shall be approved by the govenment prior to sale to consumers.

Gas pricing was formally approved only in case of Reliance's KG Basin in 2013-14. RIL submitted a proposal of price formula based on international crude prices with a floor and ceiling price and constant factor. The price formula finally approved by the Empowered Group of Ministers (EGoM) constituted on August 13, 2007was:

Selling Price (US$ / mmbtu) = 2.5 + (Average Brent Price - 25)^0.15 with a ceiling of crude oil price of US$ 60 per barrel and a floor of US$ 25 per barrel. The price was based in Net Heating Value/NHV basis) at the delivery point at Kakinada.

For other fields under NELP, the pricing was based on arm's length basis only after approval of price basis / formula by government.

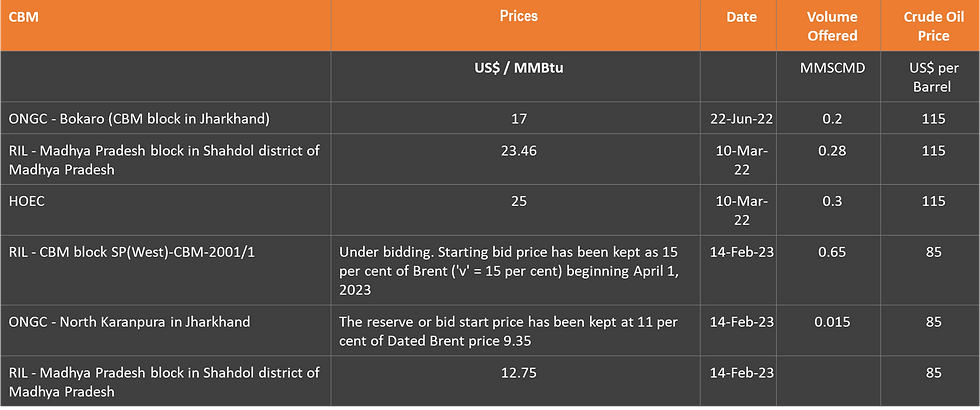

Pricing for Coal Bed Methane (CBM) blocks

The sale and pricing of Natural gas from CBM Blocks is defined under Article 18 of CBM Contract. As per Article 18.1 of the Contract, the Contractor shall have freedom to sell CBM at arm's length prices in domestic market through open bidding process.

Blocks offered under various regimes

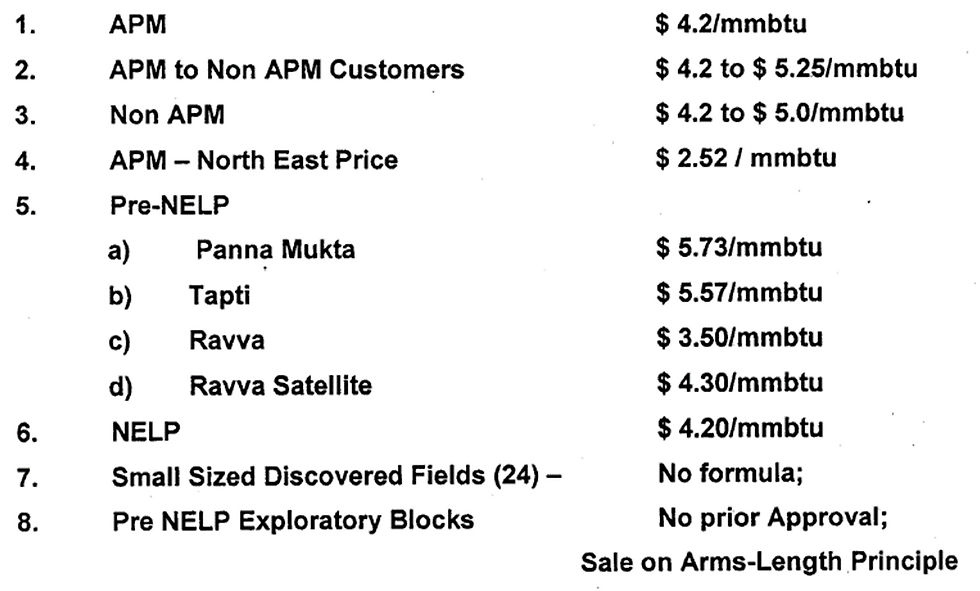

Summary of Gas Prices under different regimes in India in 2014

Source: Report of the Committee on Gas Pricing - 2014

New Domestic Natural Gas Pricing Guidelines, 2014

On October 1, 2014, Government of India notified "New Domestic Natural Gas Pricing Guidelines, 2014" vide Gazette notification No. 22011/3/2012-ONG.D.V.

As per the guidelines, natural gas prices in India were fixed for 6 months period based on volume weighted prices prevailing at three international gas trading hubs viz Henry hubs in US, National Balancing Point in UK, Natural Gas Exchange (NGX) in Alberta, Canada and Russia.

The formula to arrive at the price was based on volume weighted average prevailing at four natural gas hubs mentioned above. Hub prices were taken for the trailing 4 quarters, with a lag of one quarter. The first price was based on prices prevailing in the three hubs and Russia between July 1, 2013, and June 30, 2014, and prices would come in effect from November 1, 2014, and were valid till March 31, 2015. Thereafter, they were revised for the period April 1, 2015, to September 30, 2015, on the basis of prices prevalent between January 1, 2014, and December 31, 2014, with a lag of a quarter (January 1, 2015, to March 31, 2015) and so on.

Wellhead Gas Price = Annual Consumption Volume US and Mexico * Average Priceat Henry Hub + Annual Consumption Volume in Canada * Average Alberta Hub + Annual Consumption Volume in Russia + Annual Consumption Volume in European Union* Average Price at National Balancing Point (UK)

Divided by: Annual Consumption Volume US and Mexico + Annual Consumption Volume in Canada + Annual Consumption Volume in Russia + Annual Consumption Volume in European Union

Less: US$ 0.50 / MMBtu towards transportation and treatment from each of three hubs and Russian Price

Wellhead prices refer to price of gas receivable by producers of gas at contract area / lease area from buyer of gas. In case of on-land blocks, it is price receivable by producer in contract area.

In case of offshore blocks, if the gas is processed and sold in the offshore contract area, the price receivable at offshore will be the wellhead price.

If the gas is brought to landfall point for processing and is sold at landfall point, the facilities located in the landfall point will be considered part of the contract area and the price receivable at landfall point will be the wellhead price.

The guidelines noted that in North Eastern Region (NER), 40% subsidy would continue to be available for gas supplied by ONGC/OIL. However, as private operators are also likely to start production of gas in NER, and would be operating in the same market, this subsidy would also be available to them to incentivize exploration and production. Price determined under these guidelines would be on GCV basis.

The prices are based on Gross Calorific Value which is the quantity of heat produced by its combustion – at constant pressure and under “normal” (standard) conditions (i.e. to 0 degree Celsius and under a pressure of 1,013 mbar.

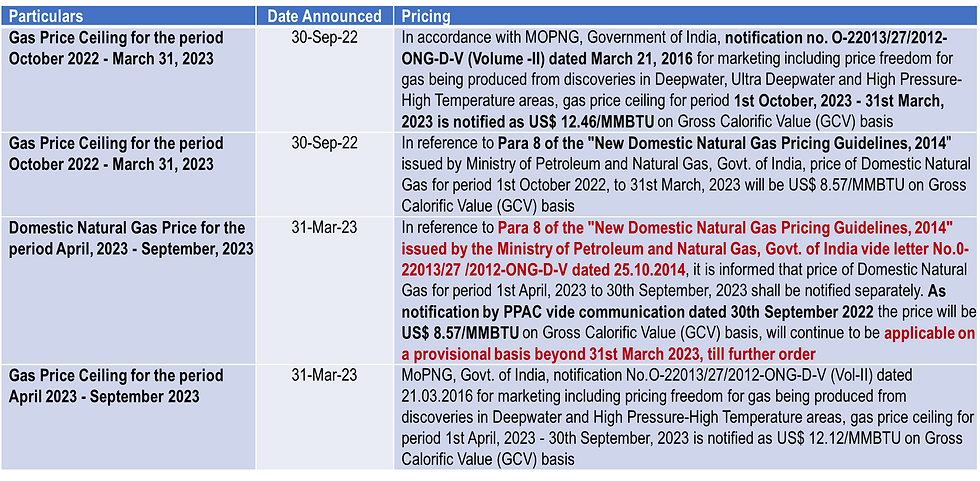

After 2014, Government of India, from time-to-time, notified changes to prices of natural gas based on New Domestic Natural Gas Pricing Guidelines. Following are some of the recent notifications:

Source: Ministry of Petroleum and Natural Gas India

On April 6, 2023, Government of India announced new domestic natural price for the period of April 1, 2023, to April 7, 2023. Two notifications were announced are as follows:

Source: Ministry of Petroleum and Natural Gas India

As per notification made by PPAC vide No. PPAC/Gas Pricing/April, 2023, dated April 7, 2023, in accordance with Para 8 of the "New Domestic Natural Gas Pricing Guidelines, 2014, issued by MoPNG, Government of India vide letter No. O-22013/27/2012-ONG-D-V dated October 25, 2014, and in furtherance to PPAC Notification No. PPAC/Gas Pricing/April 2023-September, 2023 dated March 31, 2023 read with Para 3 of MoPNG;s Notification No. L-12015/1/2022-GP-II dated April 7, 20123, price of domestic natural gas for the period April 1, 2023 to April 7, 2023 was notified as US$ 9.16 per MMBtu on Gross Calorific Value (GCV) basis.

As per another notification made by PPAC, with reference to MoPNG notification No. L-12015/1/2022-GP-II, APM price of domestic natural gas for the period April 8, 2023 to April 30, 2023 is notified as US$ 7.92 per MMBtu on GCV basis. Further in accordance with Para 4 of the said notfication the gas produced by ONGC/OIL under APM price mechanism from nomination fields will be subject to a ceiling of US$ 6.50 per MMBtu on GCV basis. However, Gas produced from new wells or well interventions in the nomination fields of ONGC & OIL, would be allowed a premium of 20% over the APM price.

PIB press release mentions that new formula to calculate natural gas prices is for nomination fields of ONGC/OIL, New Exploration Licensing Policy (NELP) blocks and pre-NELP blocks, where Production Sharing Contract (PSC) provides for Government's approval of prices.

According to the announcement, prices of natural gas shall be 10% of the monthly average of Indian Crude Basket and shall be notified on a monthly basis rather than 6 months as per earlier guidelines for these fields. Prices are appliable to gas produced by ONGC & OIL from their nomination blocks, which is priced under APM mechanism shall be subject to a floor and a ceiling. The floor is US$ 4 per MMBtu.

Further, as per the announcement, there shall be no revision in the ceiling price for two years, after which the cap will increase by 25 cents per year.

Further, as per MoPNG, Government of India, notification No.O -22013/27/2012-ONG-D-V (Vol-II) dated 21.03.2016 marketing including pricing freedom for gas being prodµced from discoveries in Deepwater and High Pressure-High Temperature areas, gas price ceiling for period 1st April, 2023 - 30th September, 2023 is notified as US$ 12.12/MMBTU on Gross Calorific Value (GCV) basis was allowed.

Will new pricing guidelines help CGD companies?

To anayse the impact of new pricing policies on CGD companies we need understand the sources of natural gas for these companies, their delivered prices, allocation of domestic gas to CGD companies, demand projections of natural gas and proproportion of cheap or high priced natural gas in the proportion to total supply as natural gas is key input cost for CGD companies.

A. Allocation of Domestic Gas to CGD companies

As per MoPNG, CGD companies are allocated natural gas via notification by MoPNG under "Guidelines for domestic gas supply to Compressed Natural Gas (CNG) and Piped Natural GAS (PNG) segments of City Gas DIstribution network" under MoPNG circular No: L-16016/3/2020-GP - I - Part (1).

As per revised guidelines issued on February 3, 2014:

GAIL would supply domestic gas to CGD entities for CNG and PNG (Domestic) at uniform base price. However, delivered price of domestic gas to individual CGD entities may vary on account of: a. Transportation Charges and b. Local taxes and duties

Additional allocation/supply above average consumption of 6 months by CGD for CNG and PNG (Domestic) to supplied by pro rata cut of all customers except NELP of non-priority sectors decided by Central Government

To protect interest of small customers i.e., those having allocation of domestic gas up to 50,000 Standard Cubic Meter per day (scmd), present level of supply, up to a maximum of 5000 scmd, shall be kept out of purview subject to operational imperatives. Present level of supply for this purpose would be actual average consumption in 6 months.

To operationalize allocation/supply arrangements all concerned entities to facilitate gas swapping arrangements as per guidelines dated March 14, 2012, issued by MoPNG.

While efforts are being done to meet 100% requirements of CGD entities but gap in consumption and allocation may be meet through RLNG. This methodology will be reviewed quarterly by MoPNG as per demand-supply scenario of natural gas.

These guidelines are applicable to CGD entities in NE region (Assam Gas Company and TNGCL)

This guideline was further amended on August 20, 2014. As per MoPNG circular the following was decided:

Allocation exercise will be undertaken by GAIL after end of every six months.

PPAC will within completion of 20 days of a half year submit average consumption by each CGD entity.

Further to meet fluctuation in demand of CGD sector GAIL is authorized to supply additional 10% domestic gas over and above 100% requirement for CNG and PNG (Domestic) calculated as per last half yearly consumption.

GAIL to divert domestic gas except NELP gas from non-priority sector by applying pro-rata cuts to meet CNG and PNG (Domestic) requirements.

Pro rata cuts shall not be applied on supply up to a maximum of 5000 scmd to small consumers having allocation of domestic gas up to 50,000 scmd and 1.1 million Standard Cubic Meter per day (mmscmd) of APM gas allocated to TTZ.

Gas shall be supplied at uniform base price to each CDG entity.

Additional requirement of gas, if any, between two review periods over and above domestic gas supplied shall be sourced by individual CGD entities

Only those CGD entities in their respective GA will be considered for allocation who have been allocated domestic gas as per MoPNG guidelines dated February 3, 2014.

GAIL shall seek permission from MoPNG before making supply of domestic gas to any new CGD entity/GA of existing CGD entity

Guidelines will be applicable till divertible gas from non-priority sector is available with GAIL and GAIL shall submit statement on cuts imposed on non-priority sector for meeting CNG and PNG(Domestic) segments

These guidelines shall not be applicable to Tripura Natural Gas Company Limited (TNGCL) and Aavantika Gas Limited (AGL) in view of operational issues

For the Northeast region, MoPNG issued “Guidelines for domestic gas supply for CNG and PNG (Domestic) segments of CGD networks in Northeast region” bearing Policy Guideline No. 01/2020-PNG/GP on September 28, 2020.

1. Existing guidelines of domestic gas allocation for CNG and PNG (domestic) usage in rest of country to be extended to Northeast Region

2. GAIL will make allocation to respective CGD and same would be supplied by ONGC/OIL for nearest technically feasible sources as per prevailing policies of the of government (Nomination fields, small fields etc.)

3. GAIL to maintain separate account for Northeast region

4. Such supplies will be made by applying pro-rat cuts on existing technical feasible consumers as per extant guidelines applicable for rest of India

5. Small consumers (mostly Tea Gardens) whose allocation is less than 50,000 scmd will be protected as applicable in rest of country

6. Gas supplied to CGD entities for new Gas will be without subsidy

7. Weighted Average price of Gas will be worked out by GAIL for all GAs of Northeast Region.

8. All other terms and conditions of the CGD gas allocation guidelines will remain same as applicable in rest of India

On April 9, 2021, MoPNG came out with Policy Guidelines No. 1of 2021-PNG/GP for co-mingling of domestic gas for supply to CNG and PNG (Domestic) segments for registered CGD Networks. The following was decided:

1. The scheme of co-mingling of Compressed Biogas (CBG) generated progressively under the SATAT scheme meeting the technical standards with the natural gas in CGD network will be operationalized.

2. GAIL will finalize operational modalities for supply of CBG co-mingled with domestic gas at uniform base price across all CGD entities for CNG (T) and PNG (D) segment of CGD network.

3. The scheme envisages the share of co-mingled CBG in the total domestic gas supplied to CNG (T) and PNG (D) segment of CGD sector reach up to 10%.

4. The scheme will be reviewed after a period of three years or as and when the percentage of CBG in the overall mix of CNG(T)/PNG(D) in the CGD sector reaches 10% whichever is earlier.

5. All other conditions in the guidelines dated February 3, 2014, and August 20, 2014 (as amended) shall continue to apply subject to these guidelines.

On October 1, 2018, a program called Sustainable Alternative Towards Affordable Transportation (SATAT) to establish an ecosystem for production of Compressed Biogas (CBG) from various waste/biomass sources in India was announced.

As per guidelines notified on May 6, 2022 for supply of domestic gas to CGD companies for CNG and PNG, the following was decided:

Revision of allocation for supply of pooled natural gas to CGD companies for CNG and PNG will be done on quarterly basis

GAIL will supply pooled natural gas of 2.5% over and above 100% requirement for CNG and PNG for each Geographical Area (GA) in quarterly allocation period. The requirement will be calculated on basis of consumption in the previous quarter. Requirement of pooled gas be done for each GA seperetly.

Supply by GAIL to new GAs, which are commissioned in a particular quarter, (consumption upto 6000 SCMD) over and above the 2.5% additional supply by GAIL.

To meet the shortfall in availability of domestic gas for supplies of pooled natural gas, GAIL will source domestic High Pressure and High Temprature (HPHT) oil and gas fields at ceiling price/actual price whichever, is lower, as per prevaling guidelines for mixing with available APM and Non-APM gas.

For any further requirement GAIL will sources Long term RLNG for mixing with avialable APM/Non-APM gas. GAIL may procure spot RLNG for mixing in the pool.

Pooled natural gas including sources mentioned at 4 and 5 above will be supplied to CNG and PNG segments as per respective allocation at a uniform base price arrived at in cilsultation with PPAC. GAIL can charge marketing margin as per guidelines on supply of domestic pooled gas for CNG and PNG segment.

No re-allocation or diversion of pooled natural gas allocated for supplies in a particular GA to a different GA for same authorized entity shall be allowed.

In order to verify end use of pooled natural gas for CNG and PNG purpose CGD entities shall furnish provisional consumption figures on monthly basis within 7 days of end of calender month. CGD companies will be penalised 2.5% untill they are not able to submitt CA certificate.

This methodology will be reviewd quarterly by MoPNG as per demand-supply scenario of natutal gas. As per revised guidelines issued on February 3, 2014, GAIL would supply domestic gas to CGD entities for CNG and PNG (Domestic)

B. Sources of natural gas for CGD companies and their delivered prices

As noted CGD companies are allocated domestic natural gas for their requirement to the extent:

100% of requirement based on consumption pattern submitted to PPAC by CDG companies

Additional 10% over the requirement over and above 100% requirement

Supply of pooled natural gas of 2.5% over and above 100% requirement based on consumption in the previous quater.

GAIL to supply natural gas over and above the 2.5% additional supply to new GAs, which are commissioned in a particular quarter, (with consumption up to 6000 SCMD).

To meet the shortfall in availability of domestic gas for supplies to be pooled. GAIL will source domestic High Pressure and High Temperature (HPHT) oil and gas fields at ceiling price/actual price whichever, is lower, as per prevailing guidelines for mixing with available APM and Non-APM gas.

For any further requirement GAIL will sources long term RLNG for mixing with available APM/Non-APM gas. GAIL may procure spot RLNG for mixing in the pool

Lets look at prices of natural gas from various sources after announced of new pricing guidelines and build-up of natural gas prices for CGD companies.

Build-up of natural gas prices for CGD companies is as follows:

Recent prices from CBM autions

Recent prices LNG prices

India has 5 operational LNG important terminals at Dahej, Hazira in Gujarat, Dabhol in Maharastra, Kochi in Kerela and Ennore in Tamil Nadu. India gets its LNG on long term contracts, short term and spot rates. According to recent news by Mint "Spot LNG prices have fallen to about $14-15 per metric million British thermal units (mmBtu) from average of over $45 per mmBtu in the fiscal second quarter, and average of slightly above $30 per mmBtu in the third quarter 2023"

Nomination, Pre-NELP and NELP prices

With the announcement of New Pricing guidelines APM prices will be capted at US$ 6.50 per MMBtu for two years (thereafter increase by 25 cents) decreasing from US$8.57 per MMBtu as per Gas Price Ceiling notification by MoPNG for the period October 2022 - March 31, 2023, announced September 30, 2022. Price for High Pressure/High Temprature fields like Reliance Industries for April 1-October 1, 2023 is at $12.1/mmbtu. However, for gas from new wells and well intervention in nomination blocks will be at a 20% permium over APM prices or US$ 7.8 per MMBtu.

C. Demand projections

After completion of 11th CGD round 96 percent of India's population is expected to be covered under CGD network this will result in boom in demand for natural gas in India. But with limited domestic supply LNG will play major role in supply of natural gas.

D. Proportion of cheap or high priced natural gas in the proportion to total supply

Gas produced from old fields make up of about two-thirds of all domestically produced gas in India. IGL and MGL source 80% and 85% respectively of its volumes from fields that are priced on APM prices. Similarly, Green Gas Limited sources approximately 25% volumes from these fields. With the falling supply of gas from old fields CGD companies will have to rely mostly on imported LNG. in 2021-22 almost 48% of CGD consumption was sourced from LNG

Impact of New pricing guidelines on CGD companies

With rising demand and falling supply from cheap domestic natural gas suppliers reliance on imported LNG will substantially increase. Recent fall in spot LNG prices from its peak of US$45 per MMBtu by US$ 14 to 15 per MMBtu, due to low winter demand in Europe, will help CGD players in the short term but not by much in reducing its input costs as supply from cheap sources decreases and LNG prices still being higher than even the domestically produced gas having peak price of US$ 12.1 per MMBtu from Deepwater/Ultradeepwater fields. Although allocation of natural gas to CGD players is assured by GAIL to not only meet existing demand but also additional demand, however, falling doemstic production does not help. Therefore, in the medium (5 Years) and long term (10 years) CGD companies will see margin pressures.

Will new pricing guidelines help Natural Gas producers?

To boast investment, pricing plays an important role. But before we analyse the impact of new pricing guidelines, it is important to mention here that the policy does not mention anything about small discovered fields, fields disovered under OLAP rounds and CBM. Therefore, we assume for the time being that gas from these sources will be based on open arms length bidding process.

The recent announcement by the government will not help ONGC and OIL to boast production from old fields in the nomination blocks since the price will fall from current US$ 8.57 per MMBtu as per Gas Price Ceiling notification by MoPNG for the period October 2022 - March 31, 2023 to a ceiling of US$ 6.50 per MMBtu on GCV basis. But it will ceratinly help since gas produced from new wells or well interventions in the nomination fields of ONGC & OIL will have a premium of 20% over the APM price as per the new revised guidelines. For Pre-NELP, and NELP Policy blocks the price will be 10% of monthly average of Indian crude oil basket.

The long term impact of new pricing guidelines on natural gas producers like NOCs ONGC/OIL and Private and JV players will depend on internatinal crude oil price projections and India's crude oil basket. Therefore, we shall first understand what Indian crude oil basket is made up off and then see how this will move in the future.

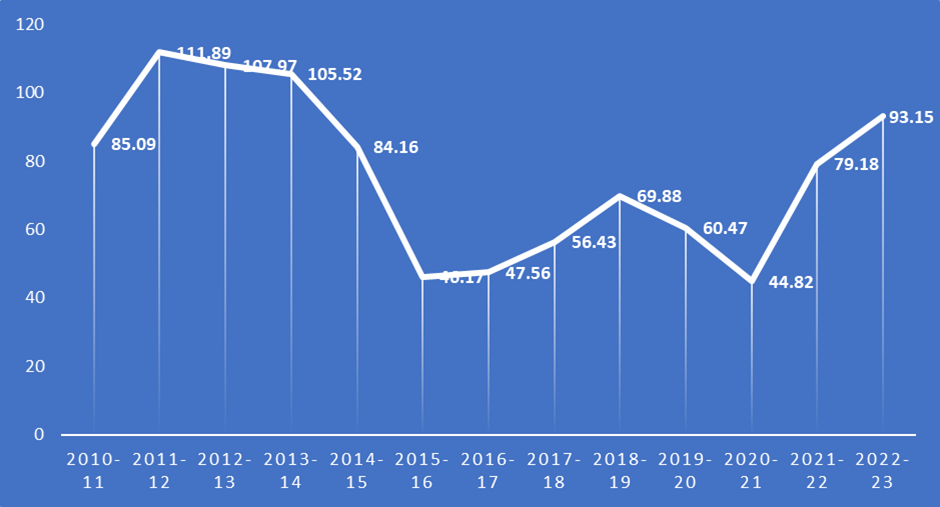

India's crude oil baset is made up of Sour grade (Oman & Dubai Fateh Crude Oil average) and Sweet grade (Brent Dated) of Crude oil in the ratio 75.62 : 24.38. The historical average price trends is given in the figure below for reference.

Historical Average India crude oil basket prices (US$ per Barrel)

Source: PPAC

Long term outlook (10 years)

Brent prices

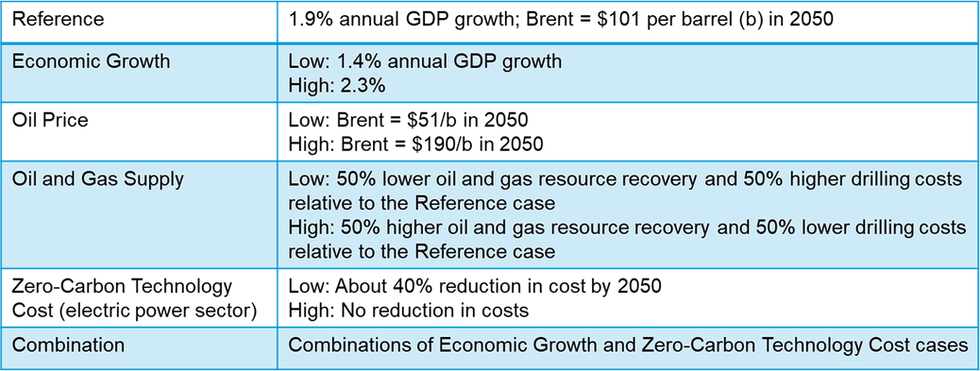

As per EIA latest forecasts in the Annual Economic Outlook, 2023, real Brent crude prices, in its reference case, will rise steadly after falling to US$ 87.05 per barrel in 2025. The oil price is an exogenous variable assumption. In the AEO2023 High Oil Price case, the price of Brent crude oil, in 2022 dollars, reaches $190 per barrel (b) by 2050, compared with $101/b in the Reference case and $51/b in the Low Oil Price case says the report. The report os based on following assumptions:

Source: https://www.eia.gov/outlooks/aeo/

Real Average Brent Prices

Source: https://www.eia.gov/outlooks/aeo/

Based on this price projections both NOC and Private JV players will benefit in the long run and will boast investment in India.

Sour grade (Oman & Dubai Fateh Crude Oil average)

As far as Oman sour crude prices are concerned, there is fall in Annual Total Crude Oil and Condensate reserves accoring to Ministry of Energy and Minerals, Oman. Reserves have fallen drastically from 2013 levels. This will likely increase price of Oman sour crude oil prices in the long run assuming no additional reserves are added.

Annual Total Crude Oil and Condensate Reserves

Source: https://mem.gov.om/en-us/KPI/Annual-Production-Of-Crude-Oil-Condensate

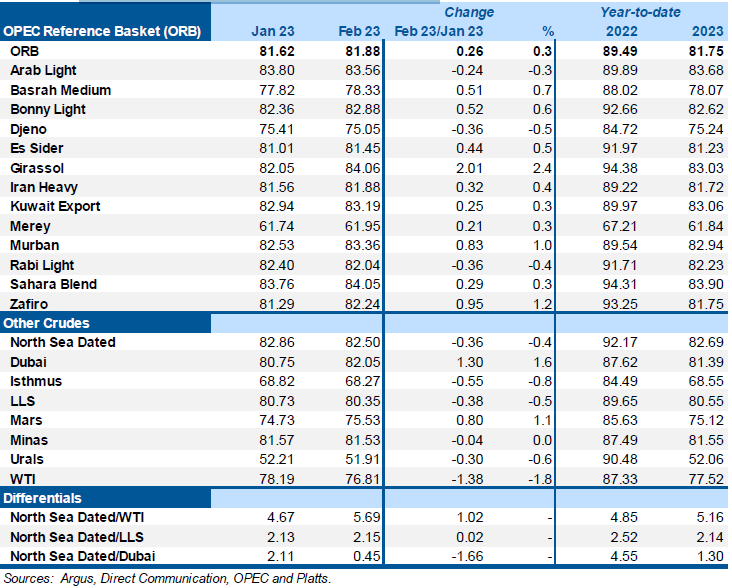

OPEC Reference Basket and selected crudes, US$/b

Dubai is also likely to fall in medium term but will increase subsequently.

Impact on Natural Gas producers

Rising crude oil prices augur well for oil and gas producers in India as it will boast revenue in the long run but in the short run they will see fall in revenues. However, actual impact can be analysed only after understanding average production costs for each oil and gas asset.

Will new pricing guidelines help consumers of CNG and PNG (Domestic)?

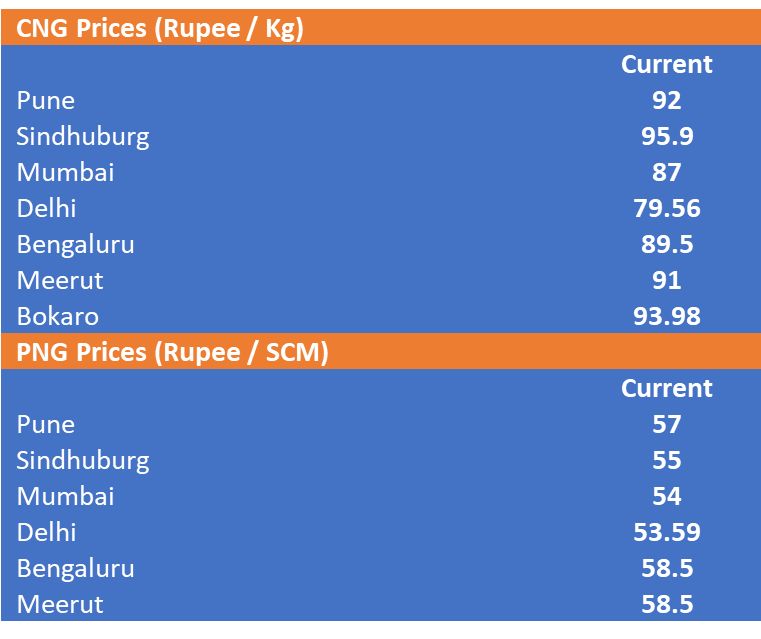

Is there a good news for consumers. Yes, for the time being, with CGD companies reducing prices. India' big CGD companies like GAIL, IGL and MGL have reduced their prices for both CNG and PNG (Domestic) from their current prices on average by Rs. 7.28 per Kg for CNG and Rs. 5.76 per SCM.

However, in the medium and long term these prices will rise again as supply from cheap domestic sources fall and LNG use to produce these products increase. But if you compare these with petrol and diesl prices the advantage will remain as CNG is still 60 and 30 percent cheaper relative to petrol and diesel prices on an average. For PNG (Domestic) the prices are relatively cheaper than LPG in certain cities while costlier in others depending on taxes and duties.

Comments