IFRS 18 - Presentation and Disclosure in Financial Statements

Will the struggle for investors and analysts ease after the new IFRS 18 standard

The reporting standard will be applied from January 1, 2027. However, the standard states that companies can apply this earlier. IFRS 18 is the culmination of the IASB’s Primary Financial Statements project.

We shall first see what IAS 1 says how income and expenses are presented in Profit and Loss or Income statement and how IFRS 18 : Presentation and Disclosure in Financial Statements will change all this.

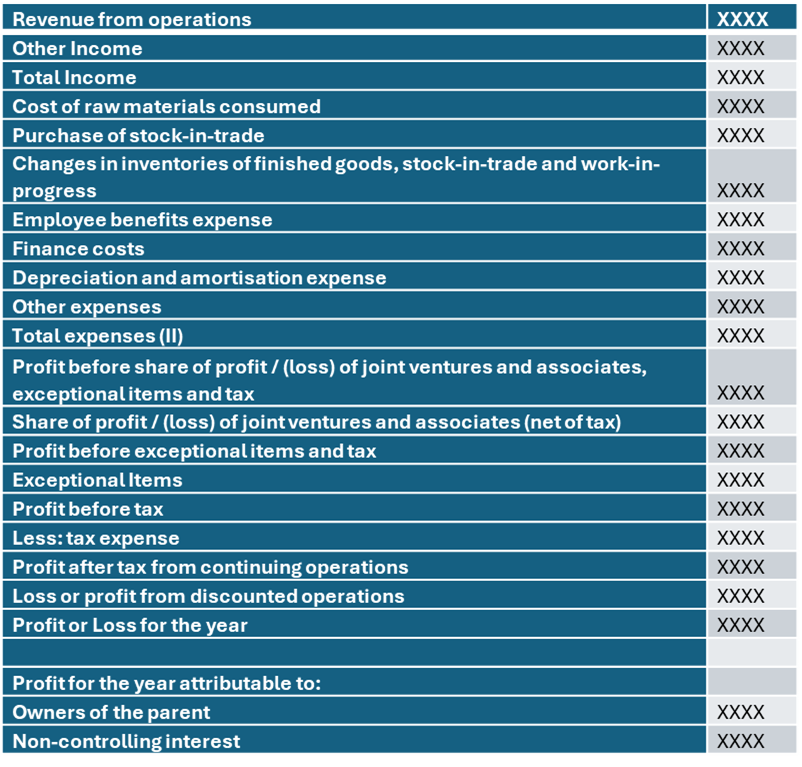

Currently, there is no specific structure how income and expenses are presented in the Profit and Loss or Income statements in IAS 1. Companies usually use the following formats in India:

Table 1: Illustrative statement of profit or loss for a general corporation, with expenses classified by nature

Table 2: Illustrative statement of profit or loss for a general corporation, with expenses classified by function

In India, most of the companies present income statements in the first format. The annual reports currently provide the following key profit subtotals as per general guidelines provided in IAS 1 with certain changes as per Division II of Schedule III of Companies Act, 2013 were adoped by India:

1. Profit before exceptional items and share of income or loss of JVs and associates and tax,

2. Profit before exceptional items and tax

3. Profit after tax from continuing operations and

4. Profit and loss for the year.

The first main sub-total is Profit before share of profit / (loss) of joint ventures and associates, exceptional items and tax usually represent operating profit

IFRS 18: Presentation and Disclosure in Financial Statements

With the coming of IFRS 18, this is about to be changed. Like IAS 1, IFRS 18 will also affect the complete set of financial statements, which include:

1. Balance sheet

2. Profit and Loss statement

3. Statement of comprehensive income

4. State of Changes in Equity

5. Statement of Cash flows

6. Notes to financial statements

With the adoption of IFRS 18 the Statement of profit or loss are to be allocated to the following newly defined categories:

Operating category

Investment category

Financing category

Income taxes

Discontinued operations

The new format will look like this:

Table 3: Illustrative statement of new format of profit or loss for a general corporation with expenses classified by function

Line items in Table 3 are for illustrative purposes and do not denote line items that any particular company would present. A company is allowed to present additional subtotals if necessary to provide a useful, structured summary of the company’s income and expenses.

The new format presents the line items which are similar to the classification given in the cash flow statement i.e. cash flow from operating activities, cash flow from investing activities and cash flow from financing activities.

What is in the operating category?

As per International Accounting Standards Board (IASB), the operating category provides a complete picture of a company’s operations. Investors use the operating profit subtotal as a measure of how a company is performing in its business activities and as a starting point for forecasting future cash flows.

The operating category consists of all income and expenses that are not classified in the investing, financing, income taxes or discontinued operations categories—income and expenses classified in those categories are items that investors generally analyse separately. The operating category will include all incomes or expenses whether they are volatile or unusual in some manner and will represent income and expenses not only from main business activities but also from additional activities if these do not meet the requirements to be classified in any other categories.

How foreign exchange differences will be classified?

Foreign exchange differences will be classified in the same category as the income and expenses from the items that gave rise to the foreign exchange differences. If classifying foreign exchange differences this way would involve undue cost or effort, a company is permitted to classify foreign exchange differences in the operating category.

IFRS 18 also includes specific requirements for classifying fair value gains and losses on derivatives and hedging instruments, and for classifying income and expenses from hybrid contracts.

How expenses will be presented in the operating category?

IFRS 18 requires a company to present expenses in the operating category in a way that provides the most useful structured summary of its expenses. To do so, a company will present in the operating category expenses classified based on:

• Nature—that is, the economic resources consumed to accomplish the company’s activities, for example, raw materials, salaries, advertising costs; or

• Function—that is, the activity to which the consumed resource relates, for example, cost of sales, distribution costs, administrative expenses.

However, IFRS 18 requires companies that present expenses classified by function will have to disclose amount of depreciation, amortization, employee benefits, impairment losses and write-down of inventories included in each line item in the operating category in the statement of profit and loss in the notes to accounts.

IFRS 18 provides flexibility to companies to classify expenses in a way that provides the most useful information to investors.

The most important: EPS

In addition to reporting basic and diluted earnings per share, companies were permitted to disclose earnings per share based on any component of the statement of comprehensive income. The company is permitted to present these figures only if the numerator is either a total or subtotal identified in IFRS 18 or a Management-defined performance Measures (MPM) given in the IFRS 18 standard.

What about the cash flow statement?

IASB has made very limited changes to the statement of cash flow statement as defined by IAS 7: Statement of Cash flows except the following:

1. Companies will be required to use operating profit subtotal as the starting point for reporting of cash flow from operating activities using the indirect method

2. Remove presentation alternatives for cash flows from interest and dividend - dividends and interest paid are generally classified in cash flows from financing activities, and dividends and interest received are generally classified in cash flows from investing activities

Limited impact on IAS 34: Interim financial reporting

The company has to now disclose information about MPMs in the interim statement. Some of the other changes (including those about subtotals) also apply to condensed financial statements in interim reports.

Will it or won’t it?

The key question that we need to answer is: will this improve comparability in the statement of profit or loss (income statement) for the investors and analysts?

Earlier companies were allowed to present key profit subtotals as per the guidelines given in IAS 1, and they used their choice to present the subtotals as they deemed appropriate. But with IFRS 18 coming into force corporates will have to present the key Profit and Loss statement subtotals as per new format especially, operating profit which has always been a bone of contention so far.

After the adoption of IFRS 18, companies will have to provide more transparency about their operating expenses numbers, which will further help investors and analysts to find and understand the information they need.

Management-defined performance Measures: The New, New

Many companies used to provide non-IFRS measures, which will now be called as Management-defined performance Measures (MPM), often referred to as alternative performance measures. Though the information was useful to the investors, most companies do not currently provide enough information to enable investors to understand how these measures.

IFRS 18 requires companies to disclose explanations of those non-IFRS measures/ Management-defined performance Measures that are related to the income statement. This new requirements will improve the transparency of these measures, and make them subject to audit. More on this in our latter blog.

Summary

Source: Project summary, IFRS Accounting standards, IFRS 18 Presentation and Disclosure in Financial Statements

Comentários