When Warren Buffett, Chairman and CEO of Berkshire Hathaway, buys a company, fully or partially, he is looking for companies that have durable competitive advantage or sustained competitive advantage. So before we dwell into ratio and rules of investment, we need to understand what is competitive advantage.

What is competitive advantage?

Competitive advantage refers to the unique strengths and capabilities that allow a business or organization to outperform its competitors and achieve superior performance in the market. It is the factor or combination of factors that sets a company apart and gives it an edge over others in terms of customer value, market position, profitability, and sustainability.

There are different types of competitive advantages that businesses can possess:

Cost Advantage: A company can have a cost advantage when it is able to produce goods or provide services at a lower cost than its competitors. This can be achieved through economies of scale, efficient operations, access to cheaper resources, or technological advancements that reduce production costs.

Differentiation Advantage: Differentiation advantage arises when a company offers unique and distinctive products or services that are valued by customers. This can be achieved through product innovation, superior quality, excellent customer service, strong brand reputation, or exclusive features that set the company's offerings apart from competitors.

Focus Advantage: Focus advantage occurs when a company focuses on a specific market segment or niche and tailors its products or services to meet the specific needs of that segment better than its competitors. By concentrating its efforts and resources on a specific target market, the company can establish a strong position and serve customers more effectively.

Technological Advantage: A company with a technological advantage possesses superior technology, expertise, or intellectual property that gives it an edge in product development, manufacturing processes, or operational efficiency. This can enable the company to offer innovative products or services, improve productivity, or deliver solutions that competitors find difficult to replicate.

Market Access Advantage: Market access advantage refers to a company's ability to enter new markets or reach customers more effectively than its competitors. This can be achieved through strategic partnerships, distribution networks, favorable relationships with suppliers or distributors, or regulatory advantages.

Now comes the question: Does a firm, in a given industry, have competitive advantage?

To find out whether a firm has a competitive advantage, Warren Buffett looks at a few key ratio trends to understand that. Before we provide the list, let's zero on some important terms:

Key terms

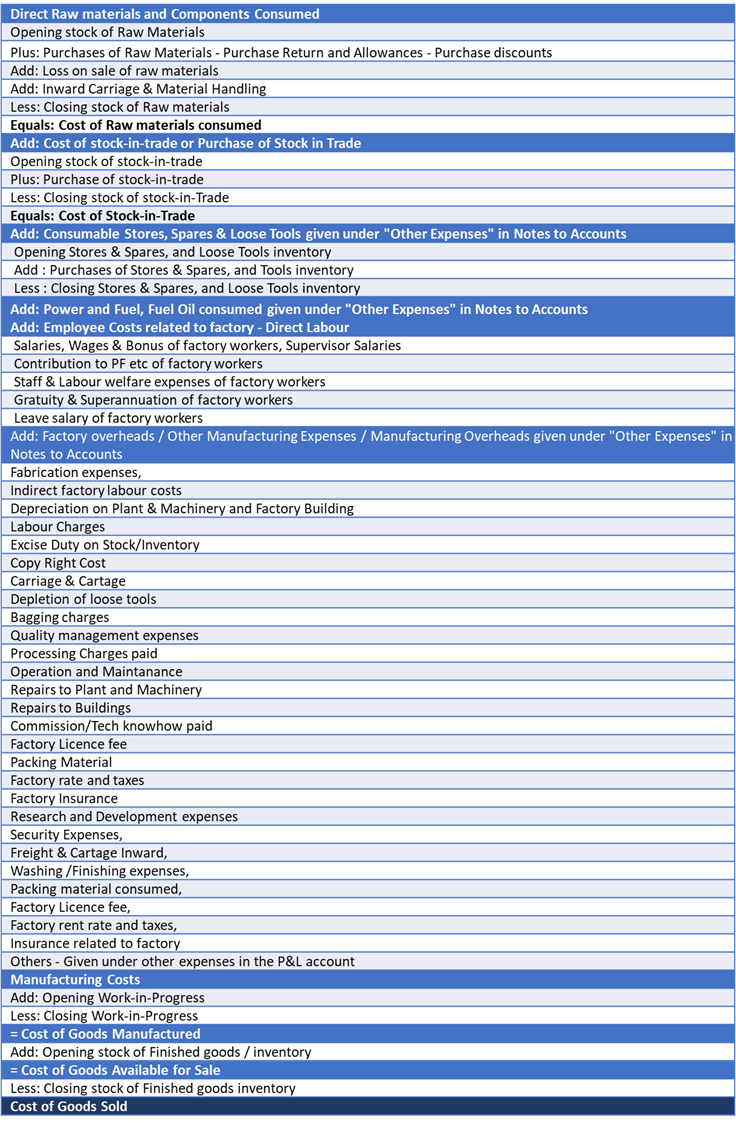

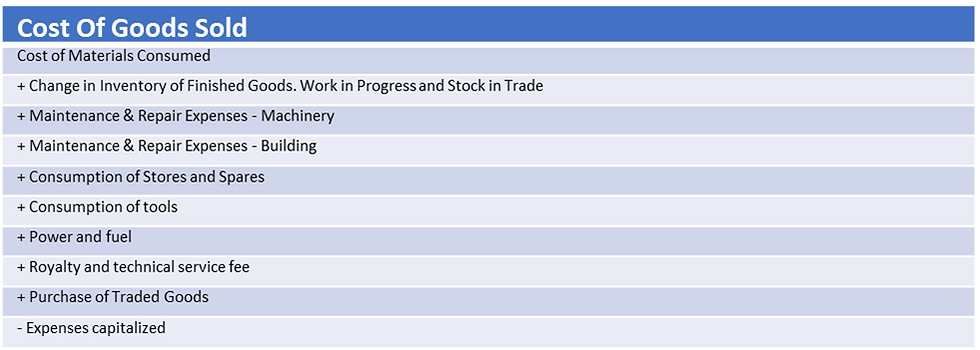

Cost of Goods sold or Cost or service or Cost of revenue:

Or

Cost of Goods Sold for Manufacturing Firms

Or

Capex = PP&E (current period) – PP&E (prior period) + Depreciation (current period)

or Capex = Investment in PP&E and Intangibles from Cash flow statement Cash from Investing section

Earning Per share = Profit Before Tax (PBT) / Shares outstanding

Yes, it sounds different. Usually it is Net Income for Common Shareholders divided by shares outstanding, but for Warren Buffett it is PBT is important to estimate return on investment. According to him, except for tax-free investments, all investments returns are marketed on pre-share basis and since all investments compete with each other, it is easier to think about them if they are thought about in equal terms.

Net Earnings: Net income for common shareholders

Net income for common shareholders = Net Income as reported less Gain or loss attributable to Non-controlling interest

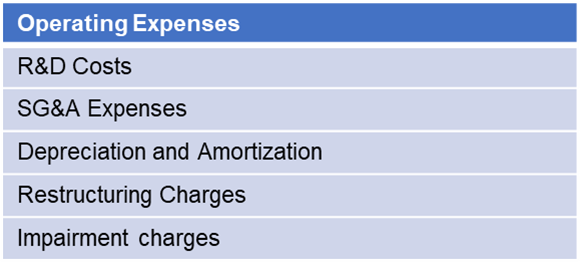

Operating Expenses

SG&A Costs: Selling, general and administrative expenses, which report the company's costs for direct and indirect selling expenses and all general and administrative expenses that were incurred during an accounting period.

When Warren Buffett looks for companies to invest, he asks the following question before buying a company partially or fully:

Does a company consistently show low gross margins?

Does a company consistently spend large sums on R&D as percentage of Gross Margin?

Does a company consistently carry high debt on its balance sheet?

Does a company consistently show no growth in Net Earnings or there is large variation in earnings?

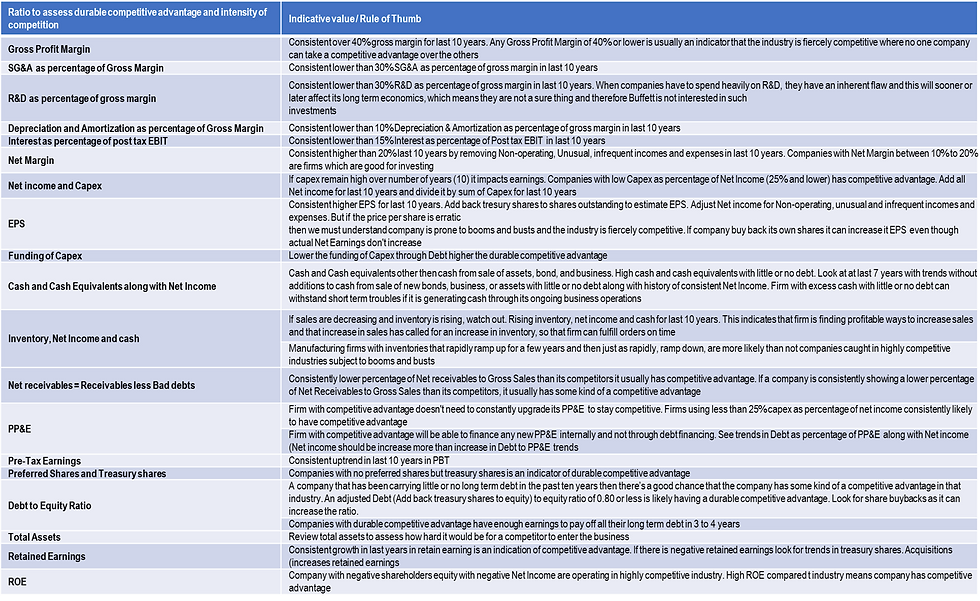

If the answer is yes, then do not invest in the company. A more detailed discussion on the ratio trends he looks at when he invests in a company is as below:

Remember, these are important for an investor and not a speculator.

Investor versus Speculator

Investors and speculators are two distinct types of participants in financial markets, each with different objectives, approaches, and risk profiles. Here's a breakdown of the key differences between investors and speculators:

A. Objective:

Investors: The primary objective of investors is to generate returns over the long term by investing in assets that align with their financial goals. They typically seek to build wealth, generate income, or achieve specific financial objectives such as retirement planning or funding education.

Speculators: Speculators, on the other hand, aim to profit from short-term price fluctuations in financial instruments, often without a long-term investment horizon. Their primary objective is to capitalize on market inefficiencies or price volatility to make quick gains.

B. Time Horizon:

Investors: Investors generally have a long-term perspective and are willing to hold their investments for an extended period. They focus on the fundamental value of assets and are more concerned with the overall performance and growth potential of their investments over time.

Speculators: Speculators have a short-term time horizon and may hold positions for days, weeks, or even minutes. They aim to exploit short-term market movements and capitalize on price fluctuations for immediate gains, without necessarily considering the long-term value of the asset.

C. Risk Profile:

Investors: Investors typically have a more conservative risk profile and seek to manage risk through diversification, asset allocation, and a long-term investment strategy. They are generally willing to tolerate moderate market fluctuations in pursuit of their long-term objectives.

Speculators: Speculators tend to have a higher risk appetite and are willing to take on more significant risks to pursue short-term gains. They often engage in strategies that involve higher leverage, options, or derivatives, which can amplify both potential profits and losses.

D. Research and Analysis:

Investors: Investors often conduct thorough research and analysis to identify investment opportunities based on fundamental factors such as financial statements, industry trends, and market conditions. They aim to make informed decisions based on the underlying value of the asset.

Speculators: Speculators may rely more heavily on technical analysis, market trends, and short-term price patterns to guide their trading decisions. They focus on short-term market sentiment, momentum, and technical indicators rather than the intrinsic value of the asset.

E. Approach to Risk:

Investors: Investors are more likely to take a measured and calculated approach to risk, considering factors such as asset allocation, diversification, and risk management techniques to protect their capital and minimize losses.

Speculators: Speculators may embrace higher levels of risk and exhibit a more aggressive approach. They may take concentrated positions, use leverage or derivatives, and be more prone to accepting losses in pursuit of short-term gains.

It's important to note that these distinctions are not always clear-cut, and individuals or institutions can exhibit characteristics of both investors and speculators to varying degrees. Furthermore, investment approaches can fall on a spectrum between these two extremes, with some strategies incorporating elements of both long-term investing and short-term speculation.

Simple rules of Investing

Rule 1: If price of a stock is below its Intrinsic Value (Calculated using DCF) : Buy the stock

Rule 2: Never Pay for a share that is more than 25 times company's Net earnings

Rule 3: Sell stocks if it is up 50%

Rule 4: Stay away from stocks at the height of the bull markets as they will be very expensive, and it is possible that even these companies may not always give a good return if you pay too much for it

Rule 5: When we see P/E ratios of 40 or more (and this sometimes happens) then it might just be the right time to sell. But if we do sell then it is not worth buying immediately something else. Take a break and invest in bonds and wait for a bear market which is around the corner to give you another opportunity soon

Comentarios